The Comprehensive Help guide Flipping Property: Strategies, Obstacles, and Prospects

Intro:

Turning property has received wide-spread recognition as a rewarding purchase strategy, captivating both expert investors and newcomers equally. The wholesale realestate appeal of purchasing distressed attributes, redesigning them, and selling for any substantial earnings is irrefutable. Nonetheless, profitable real estate property flipping demands not just a enthusiastic eyesight for potential it needs a ideal approach, meticulous organizing, and a in depth knowledge of market place dynamics. This extensive manual delves into the complexities of flipping property, exploring powerful techniques, prospective obstacles, and the myriad options offered to traders.

Understanding Real Estate Property Turning:

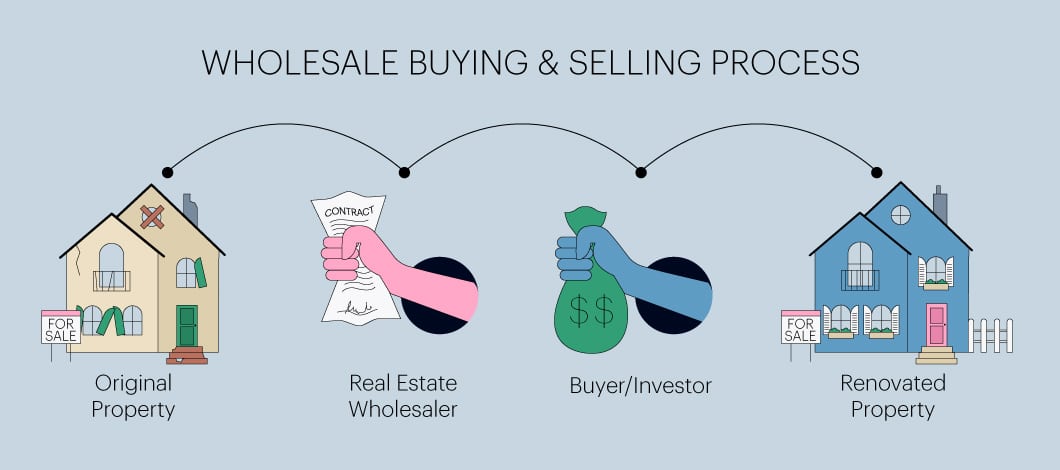

Real estate flipping requires getting attributes, generally those in need of restoration or reconstruction, boosting them, and reselling them at the greater selling price. The objective would be to have a fast turnaround and maximize the increased house value post-reconstruction. In contrast to acquire-and-carry strategies, which give attention to long term admiration and hire income, flipping is concentrated on short-term profits and quick purchase cycles.

The Turning Approach:

Choosing the best House: Productive flipping begins with determining the best residence. Brokers often focus on distressed properties, foreclosures, or homes looking for substantial fixes. Essential options involve real-estate sales, bank-possessed attributes (REOs), and distressed seller entries.

Doing Due Diligence: Comprehensive homework is crucial. This involves examining the property's condition, estimating fix and renovation fees, and studying equivalent revenue (comps) in the region to determine the prospective reselling importance. Understanding community industry styles and demand is likewise important.

Obtaining Financing: Financing a flip can be achieved through a variety of indicates, including personalized savings, tough money financial loans, private loan providers, or classic home loans. Hard funds financial loans, though more costly, are well-known because of their versatility and faster acceptance functions.

Improving the home: Restoration is definitely the heart of the flipping approach. Buyers should focus on cost-effective changes that significantly increase the property's worth. This could incorporate kitchen and bathroom remodels, floor coverings updates, fresh fresh paint, and entrance charm advancements. Managing reconstruction timelines and financial budgets is essential to enhancing success.

Advertising and Marketing: After refurbishments are complete, the home shows up for sale. Successful marketing and advertising strategies, which include expert picture taking, staging, and itemizing on multiple systems, are necessary to get potential customers. Partnering using a skilled real estate agent can aid faster sales and better negotiation results.

Great things about Turning Real Estate Property:

Higher Profit Potential: Turning real estate can generate considerable earnings in the relatively simple time, specifically in market segments with rising home principles and high require.

Hands-On Expenditure: Unlike passive expense methods, flipping permits traders to actively take part in the process, from residence selection how to wholesale houses to remodelling and sale, delivering feelings of management and fulfillment.

Industry Adaptability: Turning enables buyers to quickly conform to market problems, taking advantage of brief-word developments and opportunities which may not line up with long-term investment methods.

Talent Growth: Turning hones numerous abilities, including residence evaluation, project managing, negotiation, and marketplace evaluation, that happen to be valuable in bigger real-estate shelling out.

Challenges of Flipping Real Estate:

Market Volatility: Real estate property markets could be unforeseen, and unexpected downturns can effect reselling value and profits. Remaining informed about marketplace developments and monetary signals is essential to mitigate threats.

Reconstruction Threats: Unanticipated issues during renovations, like architectural difficulties or computer code infractions, can lead to budget overruns and project slow downs. Detailed property assessments and contingency organizing are crucial.

Loans Fees: Higher-rates of interest on hard cash loans as well as other quick-word financing options can take in into income if the house does not promote rapidly. Powerful fiscal managing and expense management are essential.

Authorized and Regulatory Conformity: Flipping qualities needs adherence to numerous nearby, state, and national rules, including building requirements, zoning laws and regulations, and make it possible for requirements. Failure to abide could lead to penalties and lawful problems.

Techniques for Profitable Flipping:

Extensive Market Research: In-range consumer research is definitely the foundation of successful turning. Being familiar with local market place dynamics, residence beliefs, and shopper personal preferences aids establish worthwhile possibilities and avoid overpaying for qualities.

Precise Price Estimation: Correctly estimating restoration fees and probable reselling worth is critical. Utilizing seasoned contractors and using detailed project programs may help management expenses and prevent spending budget overruns.

Productive Task Management: Efficient project management ensures refurbishments are finished punctually and within budget. Standard progress keeping track of, obvious interaction with installers, and adaptability in dealing with issues are crucial parts.

Get out of Method Organizing: Developing a very clear get out of technique, regardless of whether selling the property quickly or booking it all out in case the industry circumstances are undesirable, supplies a protection web and assures mobility in replying to marketplace changes.

Networking and Partnerships: Building a community of reliable installers, real estate professionals, lenders, and other pros can provide useful sources, help, and options for cooperation.

Opportunities in Real Estate Turning:

Growing Marketplaces: Identifying and buying growing trading markets with solid development probable can bring about considerable profits. These markets often times have reduced entrance costs and better appreciation rates.

Distressed Qualities: Distressed components, which includes home foreclosures and brief income, can be acquired at significant discounts, offering sufficient area to make money after makeovers.

Deluxe Flips: Great-end qualities in affluent neighborhoods can yield considerable returns, though they need larger money assets and a keen understanding of luxurious market styles.

Eco-friendly Refurbishments: Including lasting and energy-effective characteristics in refurbishments can appeal to environmentally conscious customers and potentially qualify for income tax rewards or discounts.

Technologies Integration: Benefiting technology, such as internet trips, website marketing, and undertaking administration software program, can enhance performance, entice tech-knowledgeable customers, and improve the turning method.

Summary:

Flipping real-estate offers a powerful method for buyers searching for speedy profits and energetic contribution within the house market place. When the potential for high profits is significant, it includes its reveal of obstacles and threats. Accomplishment in flipping requires a ideal technique, meticulous preparation, as well as a strong comprehension of industry dynamics. By carrying out detailed analysis, managing refurbishments effectively, and staying adjustable to showcase conditions, buyers can understand the complexities of flipping and capitalize on the opportunities it presents. Whether you're a skilled investor or perhaps a novice to real estate world, turning provides a dynamic and gratifying pathway to economic expansion and expense achievement.